A common topic in business ethics courses is international trade, which is typically covered under the rubric of “globalization.” Rare is the student who doesn’t have deeply unfavorable opinions about free trade. And rare is the business ethics text that takes a deeply favorable view of it. I want to explore the case for free trade and why it meets continuing resistance.

To put the discussion in context, let me briefly review the way in which a standard business text treats the issue. Let’s look at Joseph Desjardins’ book, a widely used text authored by a respected expert in the field. It is one of the texts I routinely use in my own business ethics classes.

Desjardins begins every chapter with a “discussion case” — almost always one in which some business or group of businesses is alleged to have behaved immorally. The “case study” approach is common among business ethics texts, but the cases selected almost always have to do with unethical business behavior. As such, they are invitations to hasty generalization: the student meets just a few examples of business behavior, and these are examples of unethical behavior. No text I know of mentions the fact that there are about 27 million businesses in America and that the vast majority of them provide valuable goods and services, meanwhile causing no harm. And no business ethics text I know of discusses cases of governmental malfeasance.

The case that Desjardins starts with concerns the practice, allegedly widespread among apparel retailers, of using sweatshops, mostly located abroad. (I should note that Desjardins never defines what he means by “sweatshop.”) He notes that in August 1995 Los Angeles police arrested the operators of a shop employing 70 illegal Asian immigrants. These workers were paid much less than minimum wage, and forced to live in an apartment complexness ethics texts, but the cases selected almost always have to do with unethical business behavior. As such, they are invitations to hasty generalization: the student meets just a few examples of business behavior, and these are examples of unethical behavior. No text I know of mentions the fact that there are about 27 million businesses in America and that the vast majority of them provide valuable goods and services, meanwhile causing no harm. And no business ethics text I know of discusses cases of governmental malfeasance. set up like a prison. In the same year, Desjardins notes, it was discovered that Kathie Lee Gifford’s line of sportswear, sold at Wal-Mart stores, was manufactured by sweatshops in Honduras that employed teenagers working 14-hour days. And he discusses in detail the accusations that Nike has readily used foreign sweatshops to manufacture its shoes — observing, however, that by 1992 Nike had responded to bad publicity on this score by developing a code of conduct that requires its suppliers to meet high standards for wages and working conditions. So here we have three cases, all more than 15 years old.

This is the extent of the data he gives for this “case study,” yet it informs all the rest of the chapter, inviting students to view all foreign trade as consisting of American industries cutting domestic production to use foreign sweatshops. Desjardins then sketches two broad categories of ethical issues regarding international business: microlevel issues about the degree to which managers should apply their own ethical standards in foreign business dealings, and macro-level issues surrounding globalization generally.

Desjardins’ discussion of the first set of issues is brief. He admits that different countries seem to have different ethical systems — for example when it comes to bribery. He rightly stipulates that the fact that ethical norms may vary does not imply that they are all equally valid and none are ultimately right or wrong. He also rightly observes that customs may not vary as much as is generally supposed. For instance, when Indonesia was ruled by President Suharto, corruption was common and widely recognized. But that didn’t mean the average people approved of it: Suharto was eventually overthrown and anticorruption laws enacted.

That said, of course the issue becomes, what universal values should bind all American countries doing business abroad? Here Desjardins is not very helpful. He quotes another philosopher, Tom Donaldson, who distinguishes between “minimalist” and “maximalist” answers to the question. The minimalist approach holds that a business is free to pursue its interests in another country so long as certain minimal rights are respected in the process. The maximalist approach holds that besides respecting certain basic rights, a company must actually produce benefits for the host country.

Donaldson takes a minimalist tack, listing universal rights that any company with operations abroad must respect: freedom of movement, ownership of property, freedom from torture, fair trials, nondiscriminatory treatment,

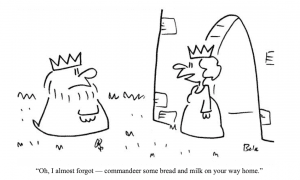

That demonstrators oppose globalization no more indicates that globalization is bad than the riots on Kristallnacht prove that Jews are bad.

physical security, freedom of speech and association, minimal education, political participation, subsistence. But Desjardins doesn’t say whether these are to be taken as positive or merely negative rights (indeed, nowhere in his text does he even discuss the distinction), or whether “respect” means “provide” or merely “not interfere with.” So the moral view is unclear: if I am opening a manufacturing plant in a dictatorship, am I to try to guarantee my employees the power to vote in that society (and how could I possibly achieve that without getting all of us killed?), or merely not stop them from voting? Or is doing business in countries without political freedom always immoral?

Donaldson’s account doesn’t tell us to whom the catalogue of rights applies: is employing a 15-year-old to run a sewing machine, with her and her parents’ consent, in a country where general education ends at the 14th year, violating her rights? Nor does it say exactly how the Donaldson list is to be reconciled with or proven superior to other lists of rights that other people may come up with. For example, nowhere on his list is a right that I hold dearly, the right to keep and bear arms. What is his rationale for excluding it? We aren’t told.

Even more vague and questionable is the maximalist account that Desjardins cites, abstracted from another business ethicist, Richard DeGeorge. This requires that the company doing business in another country do no direct harm, produce more good than harm for the host country, contribute to the host country’s development, and a number of other things. But how would a company know whether it is, on balance, benefiting the country on balance, other than the authorities in that country who have agreed to the operation? And why is it the obligation of a company to contribute to the host country’s development over and above the fact that it brings jobs and money to that country?

Desjardins then takes up the macro-level issues of global trade and globalization. He recognizes that the term “globalization” is unclear, though it certainly brings out the demonstrators every time the G20 meets, sometimes causing millions of dollars in damages. So he proceeds to define it, in a loaded way: “globalization refers to a process of international economic integration. While international trade and cooperation have existed as long as there have been nations, this process of international economic integration has become increasingly more common . . .” He cites the General Agreement on Tariffs and Trade (GATT), the North American Free Trade Agreement (NAFTA), and the European Union (EU).

It is true that international trade has gone on for millennia, but there may have been, and we will soon find good evidence to suppose that there has been a recent, huge jump in its volume. But we shouldn’t conflate simple free-trade associations, such as NAFTA, with more intense forms of association such as the EU. The EU was set up by its founders to be something like a United States of Europe, where the sovereign identity and powers of the member states would eventually be subsumed in political and economic union. In contrast, most free trade organizations are groups of countries that do not desire to integrate their economies, much less surrender their sovereignty and merge into one nation, but merely want to enjoy the benefits of increased trade.

Desjardins sketchily states the standard argument for free trade, the utilitarian idea that free movement of goods and capital among nations allows resources to be allocated in the most efficient manner, producing the greatest possible wellbeing for everyone. As corollaries, he notes (without crediting Adam Smith) that this line of thought suggests that free trade is the best way to eliminate poverty around the world, and (without crediting Frédéric Bastiat) that increased economic cooperation among nations decreases the likelihood of warfare. As Bastiat put it, “When goods do not cross borders, armies will.”

Desjardins gives no data to support or even flesh out these arguments. He only says, “As we saw in the opening discussion case for the chapter [the one on sweatshops], a variety of public interest groups so disagree with these arguments that they have been willing to take to the streets to demonstrate against globalization.” This is very feeble. To be precise, it is a howling ad populum fallacy. The fact that demonstrators, or even rioters, oppose globalization no more indicates that globalization is bad than the fact the riots occurred on Kristallnacht proves that Jews are bad.

Desjardins does rehearse three common broad arguments against globalization: globalization hurts rather than helps the poor; globalization invites a “race to the bottom” of environmental and worker protections; globalization undermines equal rights and autonomy.

In respect to the question of whether globalization harms or helps the poor, he considers “market theory” from the

Desjardins recommends a minimum wage in the host country roughly equivalent to that of the developed country.

“empirical,” “conceptual,” and “ethical” perspectives, to see whether free trade actually does improve living standards. Market theory (in his view) provides that in trade involving a more developed country and a less developed country, the likely result is that jobs will be “exported” from the developed country to the developing one, because labor costs will be lower there. This, in theory, will depress wages among workers in the developed country, and increase unemployment there. In time, however, economic growth in the developing country should increase demand for the more “industrialized” products of the more developed country, resulting in higher employment there.

Desjardins has doubts. He thinks it is “empirical” that specific, identifiable workers in the developed country will lose their jobs, but it is only “theoretical” that other workers will eventually get jobs elsewhere in the economy, and the ethical question is whether the benefits outweigh the costs. Framed in that way, the question would certainly be hard to answer.

His discussion here is breathtakingly tendentious. Nowhere does he mention the consumer. If prices drop in the developed country, consumers there obviously benefit.

And nowhere does he mention the existence of the host of “safety net” programs that are universal in the developed countries — unemployment insurance, universal education, health care systems, job training programs, and so on. Nor does it even occur to him to ask whether trade always or even typically involves companies in a developed country opening plants in developing countries, as opposed to other developed countries. This is hardly an empirically informed discussion.

Moreover, Desjardins has an impoverished view of what counts as “empirical.” The fact that we can’t always “identify” the jobs created in a developed economy when it expands trade abroad — although you sometimes can, as when foreign companies open affiliates here — hardly means that you can’t empirically measure the effects. You can, for example, measure unemployment rates for a set period before trade expansion and then for an equal period after it, to see if unemployment goes up or down.

Again, “market theory” tells us that workers in newly opened plants in a developing country will be better off — after all, they chose the job, so clearly they feel themselves better off. But Desjardins argues that if desperately poor people only have the choice of working in sweatshops or starving, the choice is not really free. From that dubious assumption flow a variety of dogmatic moral demands. He recommends that economic indicators be used to set a minimum wage in the host country roughly equivalent to that of the developed country, and that companies not be allowed to employ contractors abroad without “taking full and direct responsibility for how those workers are treated,” preferably by making them direct employees.

Other deductions proceed from the cliche “race to the bottom.” Desjardins takes seriously the idea that competition induced by free trade results in countries lowering their environmental, labor, health, and safety regulations. For example, OSHA’s extensive safety regulations make production more costly here, encouraging American manufacturers to move production lines to countries with less regulation. Desjardins ruefully notes that the WTO will not allow tariffs designed to punish countries with lower safety standards, as well as prohibiting tariffs against other countries that fail to protect against dolphins being caught while harvesting tuna, or countries that feed hormones to cattle. He admits that we don’t see a lessening of regulations in the developed countries that allow free trade — indeed, quite the reverse — yet amazingly, he doesn’t wonder if the developed countries may possibly have too many regulations to begin with, and whether many of those regulations may be bad. Yes, many European countries prohibit using hormones in cattle and the marketing of genetically modified grains, but it is quite disputable whether those regulations are scientifically defensible.

I turn now to the argument about globalization’s threat to democratic or humane political values — the argument that institutions such as the WTO, the World Bank, and the IMF are undemocratic bureaucracies, in conflict with democracy and self-determination; and that the reach of international corporations threatens the world with cultural homogeneity. Desjardins takes this argument seriously. He feels comfortable imposing Western or American values (especially as embodied in business regulations) on other cultures, but he objects to the IMF and the WTO imposing their own values, such as free trade. But participation in these organizations is voluntary. It seems fair to say that if you want the benefits that membership gives you, you have to agree to the rules, annoying as they sometimes are. And while international corporations can get certain products adopted worldwide, the Coca-Cola market hardly amounts to the destruction of other cultures. If the modern consumer society is being adopted worldwide, perhaps that’s because it appeals to

Desjardins takes seriously the idea that free trade results in lower environmental, labor, health, and safety regulations

most people in developing countries. Despite the fact that people — especially philosophy professors — in developed countries complain about shallow materialist consumerism, you seldom see them leaving developed countries to live in the developing ones.

In sum, the view of free trade offered by a typical, widely-used business ethics text is pretty unfavorable. Free trade is presented as a way to ship jobs abroad in pursuit of lower wages. Free trade is shown to result in sweatshops. It is said to lower wages and cost identifiable jobs, while any offsetting job gains are held to be theoretical. It is presented as leading to a “race to the bottom.” It is claimed to involve rich nations exploiting poor ones. The suggested solution is to strongly limit trade by regulation. Support for these ideas comes not from detailed empirical data but from the moral intuitions of philosophy professors.

We are lucky to have a superb new book on the subject, written from a contrary point of view. Daniel Griswold’s “Mad about Trade” is a comprehensive, yet crisp and spirited, consideration of the major defenses of free trade. It provides copious evidence that should surprise and interest even the most skeptical student.

Griswold, an economist at the Cato Institute who specializes in trade, starts with a brief survey of America’s increasingly globalized economy. He shows, in a telling graph, that imports and import income payments as a portion of GDP hovered around 5% from 1900 until the early 1970s, when they went nearly linearly upward to about 23% in 2000. Exports and export income receipts as a portion of GDP are a slightly more complicated picture, essentially bouncing between 5% and 10% from 1900 till the early 1970s (but with spikes during WWI and WWII, when America exported a lot of munitions), then going steeply upward to about 18% in 2000. These figures explain not only how much more globalized our economy has become over the last 35 years, but also why it has aroused increasing concern: it is growing explosively. Griswold explores the reasons for increased foreign trade, from free trade agreements (FTAs) to falling transportation costs (sealed container ships have cut losses from theft, jet aircraft are increasingly efficient, and so on).

But does free trade, on balance, help society, from consumers to workers? Griswold stresses the important point that free trade benefits consumers enormously, in the form of lower prices. No surprise there — that was Adam Smith’s argument for supporting free trade in opposition to mercantilism. But Griswold gives substantial confirming data, showing, for instance, that the industries which saw the biggest price reductions from 2000 to 2007 were almost always the ones that faced foreign competition. A recent study indicates that by lowering prices, global trade has raised the real income of Americans by 3% (or about $5,000) from 1972 to 2001. (This is another point Desjardins didn’t explore.)

Besides lowering prices, free trade provides greater product choice, greater product availability (e.g., fresh fruit in the middle of winter), and products of better quality. Griswold refutes the notions that our increased global trade is almost entirely with China (which accounts for only 15% of American imports), and that “big box” retailers

are hurting the consumer (Wal-Mart alone saves consumers about $2,300 a year per household). Less clear, of course, is whether the effect of free trade in the industries facing competition is so severe that America winds up with lower prices at the cost of higher unemployment or lower levels of worker compensation. Here Griswold argues that free trade doesn’t so much significantly increase or decrease the overall level of employment (i.e., the net number of jobs) as shift people from worse (less productive) jobs to better (more productive) jobs. He denies the claim, heard from some exponents of free trade, that it dramatically increases the level of domestic employment. And he recognizes that competition from free trade puts some companies out of business, and eliminates some jobs. But he argues that any such temporary, specific job losses from trade don’t lower the overall employment rate — for three reasons.

First, trade creates other jobs that quickly replace the ones lost. For example, lower prices for materials bought from foreign trade allow domestic producers to lower prices, thus increasing sales at home and abroad, and in turn creating new jobs. Also, the lower costs brought by trade increase the profits of domestic producers, inviting foreign investment and jobs expansion. Moreover, Griswold should have mentioned Bastiat’s observation that with the money saved from trade-induced lower prices, consumers can buy more of other products made domestically, again increasing jobs.

Second — and here Griswold does mention David Ricardo — if we lose our competitive edge in one area (because of lower prices abroad, or for that matter, some change in technology at home), the other areas of our economy will likely have their competitive advantage enhanced. Third, there are powerful economic factors, such as foreign exchange rates and government monetary policy, involved in trade. A rapid increase in imports would rapidly increase the amount of our currency in foreign banks, which would tend to weaken the dollar, thus lowering the price of American manufactured goods, resulting in increased foreign purchases of our products.

Griswold explores these concepts conceptually, but also adduces considerable empirical data to show that free trade does not increase unemployment over the long run. He also explores in detail a point often overlooked by critics of free trade — that normally the jobs lost because of foreign trade are a minor part of the general normal “job churn” the American economy experiences every year. Take a high estimate of jobs lost by trade (say, a figure put out by a thinktank tied to organized labor), and it is still only about 3% of the jobs lost in any given year. What “kills” the vast majority of jobs in America is technology, not trade.

And I would add that this is a good thing, too: the replacement of manual switchboards by computer switches killed tens of thousands of unproductive jobs but created new, more productive jobs, especially for women, who were the vast majority of those telephone operators. Women are now doctors, lawyers, professors, and scientists, rather than people who plug wires into boards. It is curious that Griswold doesn’t mention Joseph Schumpeter and his theory of creative destruction, for it explains this process remarkably well.

Griswold also marshals evidence to rebut the theory that trade results in stagnating wages. Crucial to his discussion is a critique of the use of “average real hourly wage” as a measure of the wellbeing of workers, which is the normal practice of critics of free trade. For one thing, the real hourly wage doesn’t reflect all compensation — it only looks at monetary compensation, not other forms of payment (such as healthcare benefits and 401k matching contributions). Yes, during the period from 1964 to 2006, real hourly wages remained essentially flat. But real hourly compensation rose by nearly 80%, with an upward spurt during the 1990s, when there was broad, bipartisan support for free trade. Griswold also notes that the Consumer Price Index doesn’t adequately reflect the lower prices that trade brings, or the increased variety and quality of goods available to Americans.

He takes on the claim made by commentator Lou Dobbs and others, that we are losing our manufacturing base and with it our middle class. The key point is that while our manufacturing sector has lost jobs, we have gained more highly paid jobs elsewhere, in the service industry. (Griswold might have noted additionally that all the top manufacturing countries — including China, South Korea, and Mexico — have lost manufacturing jobs over the past decade.) Our level of manufacturing output has risen; we just manufacture more with fewer people. Simply put, automation is lowering manufacturing employment all around the world. Moreover, from 1967–2007, median household income rose, and while the percentage of households with middleclass income went down, so did the percentage of poor households, leaving only the percentage of wealthy households going up.

But don’t trade deficits harm society? Griswold observes that economists distinguish between the merchandise trade balance (which measures crossborder flows of agricultural goods, commodities, and manufactured goods), the trade balance (which measures the cross-border flows of all goods and services), and the current account balance (which measures cross-border flows of all goods and services, together with income earned from all investments and all transfers of money). Now, over the past several decades, we have experienced a large trade deficit. But this is not generally a problem, because the surplus money that flows abroad flows back in the form of investments in the United States, which create jobs here. Empirical data from 1982 to 2008 show that periods of rising trade deficits are periods in which there is faster job growth, and periods of shrinking deficits are periods in which there is slower job growth. Griswold reviews in considerable depth the range of foreign companies’ operations in America. About 4.6% of America’s private workforce is now employed by foreign companies and affiliates — up by a third in 20 years. Workers for these foreign affiliates earn an average of $63,400 yearly, well above the average salary for American company employees ($48,200, 2006 figures). Foreign affiliates accounted for 19% of all U.S. exports, 26% of all U.S. imports, and 14% of all U.S. R&D spending (or about $34 billion annually).

Even when foreign investors don’t open operations here, but just passively invest in stocks, corporate bonds, bank deposits, government bonds, and various derivatives, Americans still benefit. The $15.3 trillion in foreign passive investment, which represents an expanded pool of investment

Griswold stresses the point that free trade benefits consumers enormously, into the form of lower prices

capital, has lowered the interest rates Americans have to pay on mortgages and other consumer and business loans. Lower mortgages and consumer loans mean more houses built and products made, and that means more jobs. Lower costs of borrowing for businesses and farmers mean expansion of operations and equipment, which again leads to more jobs.

Does the $20 trillion in foreignowned American assets constitute a threat to our sovereignty? Hardly. It is less than 20% of the total $110 trillion in American assets held by businesses (profit and nonprofit) and households. And only 3% of total American assets are held by foreign government agencies. If some big government holder of U.S. Treasury bills (such as China, which holds $600 billion of them) were to try to dump them in order to hurt our economy, it would be unlikely to harm us; it would be working with a small proportion of our sovereign debt and an even smaller proportion of our total asset base. Not to mention the fact that it would be wielding a doubleedged sword, hurting the value of its own assets. (I would add that such an attempt to harm us would doubtless be met with an American embargo that would economically devastate the dumpers.)

More controversial, these days, is American investment abroad. Companies that set up operations on foreign shores are routinely demonized by leftist demagogues, such as Barack Obama and John Kerry (remember his anger at “Benedict Arnold CEOs”?). Certainly, there are a lot of companies with foreign operations. Over 2,500 American firms own about 24,000 affiliates abroad – affiliates that in 2006 posted over $4 trillion in sales, employed 9.5 million foreign workers, and earned $644 billion in net income for the parent companies. Individual Americans owned $17 trillion in foreign assets, earning over $800 billion annually. So what does all this foreign investment do to American jobs?

The case that investment abroad does not cost domestic jobs starts with the fact that earnings from abroad are generally used to purchase American products, thus producing American jobs. The evidence shows that foreign and domestic operations of multinational corporations expand together, since more production and sales abroad require more home staff (managers, professionals such as accountants and lawyers, and R&D people such as engineers). If you graph U.S. parent company employment alongside foreign affiliate employment from 1982 to 2006, they track each other very closely.

Griswold makes an interesting point about those who wax demagogic about investment in China and Mexico (to take the cases most demonized by neomercantilist populists). Between 2003 and 2007, U.S. manufacturing companies invested a total of $10 billion in China and $9 billion in Mexico — but they invested $110 billion in Europe! You don’t hear the neomercantilists ranting about jobs being shipped to England. Could there be some racism lurking on the left?

Further evidence showing that manufacturing jobs are not being “shipped” to China and Mexico: between 2000 and 2006, U.S. manufacturing lost 3 million jobs, net, but employment by American corporate affiliates abroad gained a minuscule 128,000 jobs (i.e., fewer than 22,000 jobs per year). Again, the jobs were not shipped abroad, they were lost to automation.

In rebutting the neomercantilist “race to the bottom” myth, it is important to note that in the years 2003–2007, over 70% of all American manufacturing investment abroad went to these wealthy countries: Australia, Canada, Japan, New Zealand, and the European states. This seems paradoxical, but it isn’t: pace Desjardins, what companies want is not cheap labor but more profit, and a company can turn a profit in a rich country as easily as it can in a poor one. Rich countries have the wealthiest consumers, best-educated workers, most-open economies, and most-stable and transparent legal and political systems. As Griswold nicely puts it, “All that explains why more U.S. FDI [foreign domestic investment] flows to Ireland (population 4 million) than to the entire continent of Africa (population 700 million). More U.S. FDI flows to the tiny but rich European Low Countries of Belgium, the Netherlands, and Luxembourg (population 27.5 million) than to China, Mexico, and India combined (population 2.5 billion)” (106). None of these points is even mentioned by Desjardins’ text, much less addressed.

Griswold considers in detail the history of free trade in America, arguing compellingly that the early tariff barriers didn’t help the American economy on the whole, that there were more recessions per decade during the protectionist years than in the postWWII period of globalization, that the American economy has performed better after NAFTA than before it, and that not only do FTAs not violate our sovereignty; they enhance it by giving us all the right to purchase from a greater number of places.

Griswold cites a study by Scott C. Bradford, Paul L.E. Grieco, and Gary Clyde Hufbauer, calculating the benefits of lowered trade barriers to the American economy since World War II. They estimate that about $1 trillion of America’s current yearly GDP (or roughly $7,100 per typical household) comes from global trade. They further estimate that achieving full global free trade would add an additional $450 billion to our annual GDP (or as much as $4,000 per typical household).

What of the effects of globalization on the developing world? Griswold refers to a study by economists Kym Anderson and L. Alan Winters showing that opening a country up to trade increases its GDP growth by several points for many years. The impact of global free trade is astoundingly favorable. Over the past quarter century, during which trade as a share of world GDP went from about a third to well over a half, the percentage of the world’s population living in profound poverty has been more than cut in half. Over the past 50 years, the average life span in the developing countries increased by 45%, from 45 to 65 years. Global infant mortality dropped by 60%. The percentage of children inoculated against measles, diphtheria, tetanus, and whooping cough increased by 75%. The share of people in developing countries who are undernourished has been cut by more than 50%. The rate of literacy in developing countries has risen from less than half to more than two thirds. The amount of schooling that girls receive as a percentage of what boys receive went from 56% to 73%. And (again pace Desjardins) the percentage of working children, ages 10–14, fell from 25% to less than 10%, and it continues to drop.

Griswold also makes the case that Mexico is better off after NAFTA than it was before, and cites Freedom House figures showing that over the past 30 years, the number of “Not free” countries declined by a third, while the number of “Free” countries doubled. All of this is hard to square with the neomercantilist rhetoric — such as that found in Desjardins’ text — about globalization leading to poverty, sweatshops, and child labor abuse in developing countries.

Griswold concludes his argument by demonstrating that America is far from the free-trade Mecca that the neomercantilists portray. In the most recent Economic Freedom of the World Report, we are 27th among 140 nations ranked in terms of economic freedom, well behind places such as Hong Kong and Singapore. He shows in detail the crazy-quilt tariff system we currently have, and what it costs consumers. We have a trade-weighted average tariff on clothing and footwear of over 10%. Now consider sugar. Because of our subsidies and tariffs, American consumers have for decades paid two to three times the world price for sugar. Indeed, our trade barriers on agricultural products cost our consumers $12 billion a year.

And barriers extend well beyond food and clothing. We put tariffs on vehicles (2.5% on cars and 25% on trucks). We keep foreign-owned carriers from flying between one U.S. airport and another. Foreigners cannot own more than 25% of any domestic airline. And our law (the Jones Act) requires all ships carrying goods between American ports to be American built, registered, owned, and manned. All this drives up the cost of shipping and distribution enormously, impoverishing us all.

Griswold’s book is unabashedly one-sided. But if it is used to balance business ethics texts that are unabashedly one-sided against free trade, it will do much good. It is a compendium of relevant facts and statistics that increase the specificity of the discussion. In those respects it is tremendously useful. As full a case as Griswold presents, however, there is even more to be said in defense of free trade.

Consider a point he touches on, in his brief discussion of the SmootHawley tariffs, but doesn’t elaborate in detail: what happens to a country when it indulges in protectionism? Of course, the usual result is retaliation by other nations — a trade war. The present administration presents a good illustration of this.

The Obama administration is by far the most anti-free-trade, protectionist regime since Hoover. Besides stalling the implementation of the three free trade agreements (with Colombia, Panama, and South Korea) that were negotiated by the Bush administration but not yet enacted when Obama took

To protect a couple-hundred politically well-connected truckers, rent of thousands of workers are losing their jobs

office, Obama hasn’t done a thing about free trade. He hasn’t negotiated one new treaty; he hasn’t even shown any interest in doing so. Worse, his administration has enacted a number of protectionist measures that have drawn retaliatory measures from abroad.

For example, under the terms of NAFTA, a small number of Mexican truckers were allowed access to the U.S. market on a tightly monitored basis. Furious at the prospect of foreign truckers competing with their members, the Teamsters union, big contributors to Obama, got him to cancel the program last year. The result was predictable: Mexico put steep tariffs (as high as 45%) on a wide range of U.S. goods, from paper to grapes. The tariffs have totaled $2.4 billion. As a consequence, workers in businesses from paper mills in Wisconsin to farms in Washington state — an estimated 25,000 people — have lost their jobs.

Thus, to protect a couple hundred politically well-connected truckers, hundreds of millions of consumers are paying higher prices, and tens of thousands of workers are losing their jobs.

Another example concerns Brazil. Lavish government subsidies to American cotton growers have in effect frozen Brazilian cotton growers out of our market. Not surprisingly, Brazil filed a case against us with the World Trade Organization and prevailed. Brazil now has the right to retaliate, and is now warning us that it is prepared to hit over a hundred categories of American exports with tariffs of up to 100%. The Obama administration is now proposing to subsidize the Brazilian cotton growers to the tune of $147 million.

So to protect a relatively few American cotton growers, hundreds of millions of consumers must pay higher prices, and tens of millions of taxpayers must pay higher taxes.

If the case for free trade is so rationally and empirically compelling, why do people — including bright students and even some of their teachers — so often oppose it? I suggest that the reasons are not logical but psychological.

Start with the most obvious psychological motive for opposing free trade — greed, simple greed. The two groups most opposed to free trade are

The two groups most opposed to free trade are organized labor and inefficient business. Both groups spend enormous amounts of money trying to stop it.

organized labor and inefficient business. Both spend enormous amounts of money running ads against free trade and trying to elect candidates who will enact laws to stop it. In the 2008 election alone, organized labor spent $450 million to elect candidates (well over 90% of the money flowing to Democrats), and as a result we have the most protectionist regime in nearly three quarters of a century. And many if not most industries have in the past lobbied for protection, with some (such as the auto and steel industries) becoming notorious for it.

But to understand why there is resistance to free trade among the public generally, we should turn to the psychology of persuasion and behavioral economics. Robert Cialdini’s approach is instructive (as, for example, in his book “Influence: the Psychology of Persuasion” [Morrow, 1993]).

He notes that all animals (humans included) have a variety of built-in psychological mechanisms (or “fixedaction patterns”). A psychological mechanism is a pattern of behavior that occurs whenever a specific feature of the environment (the “trigger feature”) is encountered. A female turkey will exhibit “mothering” behavior (such as warming, cleaning, and huddling chicks beneath it) whenever she hears a specific “cheep cheep” noise typically emitted by turkey chicks. This is not a rational response to observing a distressed chick. If a tape recorder buried on a stuffed skunk (a natural enemy of the turkey) emits the same noise, the turkey will exhibit the mothering behavior toward the stuffed skunk.

These mechanisms are wired into animals by evolution. They usually have worked well in the animal’s environment — they have survival value. But they can occasionally prove dysfunctional. Other animals may learn to mimic the triggers, as when females of one firefly species mimic the mating signals of another species, luring males of that second species in, to become their food. Or the environment may change dramatically: humans evolved in conditions where food was scarce, so we crave sugar and fat, but that craving leads to obesity when food becomes plentiful.

Humans have many wired-in psychological mechanisms — and some of them are pertinent to the issue of free trade.

One is a weakness for social proof: people tend to judge what is proper by looking at what other people do. TV sitcoms have laugh tracks because when you hear other people laughing, you feel as if you should laugh as well. Then there is association: when two things occur together, people tend to think they are connected, even if there is no real causal connection between them — as when we associate favorable traits such as honesty and kindness with physical attractiveness. In addition, there is salience: people tend to notice what is novel or striking in a situation. In a robbery, they focus on the gun, rather than, for instance, the clothes that the robber may be wearing. Sympathy is also a factor: people tend to want to help others in need. Shown a picture of someone being pursued by wolves, we innately hope that he or she escapes. It’s easy to see that people also practice entrenchment: once committed to a course of action, they prefer to stay in it, even if the consequences are unexpectedly bad. Behavioral economist (and Nobel laureate in economics) Daniel Kahneman has shown that people are loss-averse: they will risk more to keep the $200 they have than to earn $200 more. And, to complete this brief list of examples, there is the reaction to scarcity: people tend to value more what they perceive to be in short supply. For example, in times of gasoline shortage, people will tend to top off their gasoline tanks more quickly than in normal times.

Several of these mechanisms help explain the aversion people feel toward free trade. The mechanism of salience explains why we are so struck by the jobs that are lost when an industry fails, while not being struck by the new jobs created by more productive industries. In Bastiat’s terminology, we see what is salient, and what is not salient remains unseen. Sympathy leads us to be concerned with salient images of workers laid off, perhaps because of foreign competition in their industry. Protectionists exploit that concern, arguing that we should protect what is salient, the workers employed by an inefficient company. The workers who could have been employed in more productive enterprises had the company been allowed to fail are unseen, so do not elicit the same sympathy.

Entrenchment explains why we want to cling to manifestly less productive jobs, rather than the more productive ones we get when we open our borders to trade. And association — to cite a third example — plays a big role in the protectionist’s arsenal. I see an FTA signed, and plants close, so I assume the FTA caused the plant to close.

If it is indeed true that people resist free trade for reasons that are more often psychological than logical or empirical, it suggests two points for those who want to see free trade flourish. First, any politician who seeks to advance free trade had better be prepared to make the case forcefully and often to the voting public, combating the forces of entrenchment and all the rest of the mechanisms. The best illustration of what I am getting at is Obama’s immediate predecessor in the White House, George Bush.

Bush’s record on free trade is arguably the best of any American president. He received “fast track authority,” a power conferred by Congress to negotiate FTAs free from congressional meddling, a full two years after he was inaugurated for his first term, and he had it taken away from him early by a deeply protectionist Democratic Congress five years later. But in those five years he negotiated more FTAs than all his predecessors combined. The list is long indeed: Australia, Bahrain, Chile, Colombia, Costa Rica, the Dominican Republic, El Salvador, Guatemala, Honduras, Morocco, Oman, Panama, Peru, Singapore, South Korea. All but three of his agreements were ratified.

Bush tried to conclude an even farther-reaching agreement, proposing a Free Trade Area of the Pacific at the 2007 meeting of the Asia-Pacific Economic Cooperation Conference. The proposed free-trade zone would have included the United States and most of the other Pacific countries of the Western Hemisphere, along with China, Japan, South Korea, and most other Asian nations. Given the rising protectionist sentiment in Congress, and divisions among the Asian countries, this proved to be a bridge too far, but at least Bush tried to cross it.

Yet for all the effort he put into developing FTAs, he spent little time in explaining to the public just why free trade is so beneficial. He was the first president with an MBA, so he could have done this well, one supposes. But he rarely spoke on the matter. He let resistance to free trade grow (stoked by a lot of advertising money spent by organized labor, long the arch foe of free trade) without spending any time publicly and decisively refuting it. This was a failure to lead, and it should serve as an object lesson to proponents of free trade in the future.

Second, in making the case for free trade, political leaders would do well to use arguments for free trade that also tap into the psychological mechanisms I listed, besides providing the sort of data that Griswold supplies to rebut the arguments of the protectionist.

Consider an argument for free trade that Griswold doesn’t happen to explore — the rapid growth of FTAs around the world. Unnoticed by American protectionists is the fact that most other countries, especially those in Asia and Europe, are increasingly embracing free trade.

Looking at the FTAs the WTO has recorded since 1995, we see that both their number and the pace with which they are being signed are increasing. From 1995–2003 there were on average seven FTAs signed per year. From 2004– 09, the number rose to a yearly average of 15. There are now 266 bilateral or regional FTAs recorded with the WTO, and roughly another 100 of which the WTO hasn’t yet been notified.

When you look at where these FTAs are being negotiated, it is obvious that Asia and Europe, rather than the United States, are moving farthest towards free trade. Of the 64 FTAs signed since 2005, America is party to only five (all signed by Bush), compared to eight to which the EU is party, and nine to which Japan is party. The EU now has a total of 30 FTAs, compared to the U.S. total of 17 (all pre-Obama).

The EU total includes a deal signed in May of 2010 with the Central American nations, as well as the one it concluded in late 2009 with South Korea. And the EU is close to signing an FTA with India. Still more impressive is the regional FTA signed in early 2010 between China and the Association of Southeast Asia Nations (ASEAN). This FTA eliminated more than 7,000 tariffs instantly, and created the world’s third largest freetrade zone, a zone covering one third of the world’s population, with a trading volume of $200 billion. At the same time, ASEAN signed a similar FTA with India, creating a free trade zone encompassing one and a half billion people with a trading volume of $50 billion. Even more potentially game-changing, China and India are negotiating an FTA which if concluded would cover nearly half the planet’s population.

The result is that while we have buried our heads in protectionist sand, and go month over month with nearly 10% unemployment and anemic growth, the Asian countries have embraced free trade and continue to grow briskly, at annual rates from 6 to 10%.

Now, not only is such an observation empirically sound, but it touches on at least two of the mechanisms we discussed earlier: social proof and scarcity. It indicates to Americans who are skeptical about or hostile about free trade that the other nations are embracing it rapidly. So if free trade is as bad as Obama and politicians of his ilk say, then why is the rest of the world embracing it? And if we keep delaying the expansion of free trade, we may find ourselves frozen out. Better get while the getting’s good.

Consider another argument for free trade, one recently given by the presidents of Uganda and Tanzania (see Yoweri Museveni and Jakaya Mrisho Kikwete, “Free Trade and the Fight Against Malaria,” Wall Street Journal, July 26, 2010). Malaria is a vicious disease that is common in Africa. Over 200 million people suffer from it, and it kills 800,000 a year, disproportionately children. During the past decade, new diagnostic tests, drugs, and mosquitoproof netting have been developed. But as Kikwete and Museveni note, a lot of African nations still have high tariff and tax barriers to protect their domestic industries. When some of them eliminated trade barriers on antimalarial products, the cost of those products dropped, and usage correspondingly increased. So did the number of local entrepreneurs who create homegrown medical businesses producing antimalarial products.

Here is a good and forceful argument for free trade, forceful because it taps into our feelings of sympathy, especially toward children, and good because in this case those feelings are entirely appropriate.

Free trade is crucial to eliminating poverty and increasing global peace and prosperity. One can only hope that popular support for free trade will be

While we go month after month with nearly 10% unemployment, the countries that have embraced free trade grow briskly.

increased by compelling arguments and cogent facts, especially those aimed at the same psychological mechanisms exploited by the neomercantilists. Plainly, however, it will take an endless repetition of those facts and arguments to overcome not only the greed of organized interests opposed to economic freedom but also the age-old mechanisms by which hominids respond to the realities they perceive.